10 hours ago, CollegeKidd said:1) Ask them about human trials... Do you have to have third degree burns to participate? Can someone have the product tested on them if they wanted to be part of the testing process?

10 hours ago, CollegeKidd said:4) Is this TOTAL scar-free healing? No margin, etc...

1) You can't participate in human trials if that's what you're wondering. The trials are strictly for burn patients right now and are likely already under way. If they do run trials in the future for cosmetic/scar revision however, you can probably sign up and fill out a form. They may be looking for specific scars and/or specific locations for the scar.

4) I don't think I can add this question because they made it clear from several interviews, investor presentation, and images that a margin is present. It may turn out even better for humans hopefully, but I can instead, re-phrase your question and ask if the end result is virtually seamless and not visible to the naked eye.

Questions 2) and 3) I've added for you and will sort them out thanks.

Thank you for your questions everyone

If I have replied to you or liked your comment, it means I have viewed your questions and have added/merged/re-phrased them and have already sorted them out. There will be one question I will have to fit in for a hair forum, but the rest are all us.

All that's left is to await the call either today or tomorrow hopefully.

1 hour ago, Tano1 said:Thank you for your questions everyoneIf I have replied to you or liked your comment, it means I have viewed your questions and have added/merged/re-phrased them and have already sorted them out. There will be one question I will have to fit in for a hair forum, but the rest are all us.

All that's left is to await the call either today or tomorrow hopefully.

You're a good man.

On 2017-10-24 at 3:15 PM, mjg713 said:

"Lough estimates the companys potential worth could be$50-60 billion"

I don't know what to think, if this is very seasoned or an underestimate.

16 hours ago, Tano1 said:1) You can't participate in human trials if that's what you're wondering. The trials are strictly for burn patients right now and are likely already under way. If they do run trials in the future for cosmetic/scar revision however, you can probably sign up and fill out a form. They may be looking for specific scars and/or specific locations for the scar.4) I don't think I can add this question because they made it clear from several interviews, investor presentation, and images that a margin is present. It may turn out even better for humans hopefully, but I can instead, re-phrase your question and ask if the end result is virtually seamless and not visible to the naked eye.

Questions 2) and 3) I've added for you and will sort them out thanks.

Thanks, Tano.

About the margin, can you ask why there is a margin and if there are plans to perfect it so a margin won't exist in future efforts?

PolarityTE: A Comprehensive Look At The Bull Vs. Bear Cases

Summary

PolarityTE is a reverse-merger, pre-revenue, pre-clinical tissue regeneration med-tech company with a main product that's patent-pending.

PolarityTE™s first product, SkinTE, just got registered for commercialization through a non-FDA approval route. The company is ready to sell to physicians who will contribute to SkinTE's clinical studies.

SkinTE has generated a lot of buzz, as COOL stock has skyrocketed over 800% since the beginning of the year to a fully diluted market cap of over $400 million.

Is this technology revolutionary, with a large addressable skin wound market, or is it ineffective or in a niche market? With sales and studies underway, the answers will come soon.

The company™s September preferred stock financings have price protection on the conversion price, which is akin to death-spiral financing and adds to our skepticism.

PolarityTE œPolarity (COOL) is a œnovel regenerative medicine and tissue engineering platform developed by Dr. Denver Lough, the company™s CEO. In this report, we provide information and recent news on the company and weigh the bull versus bear case.

PolarityTE is the new kid on the block in regards to skin replacement therapy with a new kind of technology called SkinTE. The company claims that this new technology is œrevolutionary, and it is already making big waves. The company claims that its technology can regenerate skin to a greater extent than any skin replacement therapy today. The stock is up 800% since the beginning of the year, leaving many insiders with stock options and preferred stock worth over $1 million. However, investors don™t know much about the technology, as the company has not released much from its pre-clinical trials aside from some basic slides shown on the company™s website. Is it the blockbuster technology that the company claims it is, or is this another Dr. Phillip Frost/Barry Honig speculative high flyer which will eventually crash and burn? We analyze and discuss this question in this report.

The technology isn™t patented yet; its patent application is pending. The PolarityTE asset was reverse-merged into a stock from a failed video game company, Majesco Entertainment, at the beginning of the year. COOL has risen 8x over the past nine months and now has a fully diluted market cap of over $400 million. Recently, in September, the company sold preferred stock that has price protection for the investors, which is similar to death spiral financing.

PolarityTE™s first product, SkinTE, is preclinical and it has only been tested on mice and pigs. There have been no human trials, nor are there any scheduled on clinicaltrials.gov or elsewhere. Despite this, the company will attempt to sell its SkinTE kit to physicians. Although there is a lot of skepticism, the technology could be great and revolutionary. Time will tell to see how it performs with human trials. See a YouTube video on this kit below:

Upon speaking with Polarity™s COO, Dr. Ed Swanson, he said now that SkinTE has been registered with the FDA without the need for FDA approval, the company can begin commercialization (this regulatory route is explained below in the section "A Look At PolarityTE™s Skin Regenerative Science"). The company is going to sell it to select institutions and do clinical trials through its customers' use at the same time. Patients enrolled in the study will have a portion of their skin wound covered with SkinTE and a portion treated with skin grafts, to test which works better. Dr. Swanson claims there is already big demand among physicians to try it out. Said Dr. Swanson:

We always designed a human pilot study. These aren™t clinical FDA approval phase trials or single pivotal device type trials, this has always been a pilot study to generate high level internally controlled medical evidence of the efficacy of our products. And we™re going to compare it directly to standard of care split grafts and burn patients. These studies were designed to bring high level medical evidence and frankly that was always our goal design and that™s what we had reflected in our presentations and what we made public. What™s great is we™ve been executing on milestones ahead of schedule and we™ve been able to register the product earlier than anticipated and by registering we are able to make the product available to the markets through commercial use. So it happened that we™ll be doing both in tandem, both pilot studies and commercial application of the product.

Dr. Swanson said in regards to attending the American Society of Plastic Surgeons:

We were just at the American Society of Plastic Surgeons, we had tremendous interest and demand from all of the surgeons there, and our management team came from that world and network, and the reason we left is to build this company. We knew what we were sitting on and knew what kind of an impact it can have in this field and in medicine and I think that was reflected to us at the meeting and so many surgeons wanted us to get the product in their centers if we hadn™t already.

Upon speaking with John Stetson, Polarity™s CFO, he said:

We went to the American society of plastic surgeons conference, about 2k physicians attended. About 25% signed up to get more info for the product.

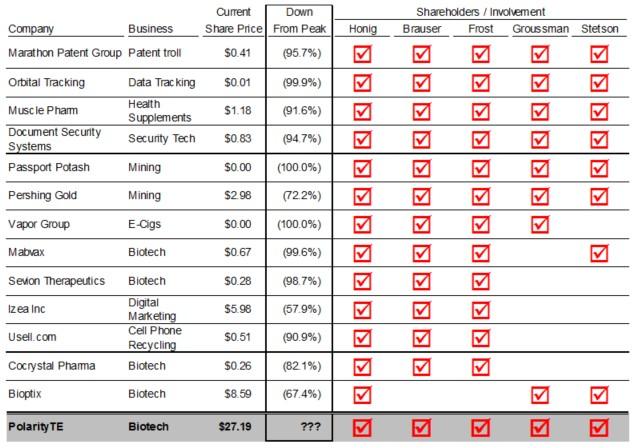

Buyer Beware: The Main Investors In This Company Have A Dismal Track Record

Whether PolarityTE™s technology is groundbreaking like the company says it is remains to be seen. However, what we do know is the lead investors behind the company don™t have good track records with stocks like this. We have seen this same group of investors promote similar, promising narratives, enticing retail investors to bid up stocks to high valuations, only to inevitably crash and burn. Even if an investor likes the story of PolarityTE™s tissue regenerative technology, they should still take a look at past stock performance from this group of lead investors.

The following is a cursory glance at the track record of major COOL shareholders Barry Honig (former director until February 2017), Michael Brauser (former director until February 2017), Dr. Phillip Frost, Mark Groussman, and John Stetson (who is also PolarityTE™s CFO). Each of the following stocks had at least three of the five of this group as main investors.

One successful investment by Honig, Brauser, and Frost that isn't mentioned on the above list, because it is no longer public, is Interclick. It was acquired by Yahoo in 2011 for $270 million. We don't know of any other long-term successful investment by this investor group, however.

One should take note that discussions for PolarityTE between Dr. Frost and Mr. Honig were very quick before a deal was made. In an August 2017 Forbes article on PolarityTE, it says:

As Lough recalls, œFrost and Honig dropped a term sheet on us 24 hours after initiating discussions ” a welcomed pace after enduring multiple rounds of VC due diligence that takes 4-5 months before anyone puts numbers in writing. Because of their vast experience in biotech, they quickly understood the potential value of our technology.

Thorough due diligence is a key part of VC investing because of the early stage nature of these assets. We believe it™s a red flag for long-term investors that Frost and Honig were so quick to make PolarityTE an offer.

A Look At PolarityTE™s Skin Regenerative Science

The following are notes from a conversation with an expert physician, who wishes to remain anonymous, who took an in-depth look at PolarityTE™s first product, SkinTE. His conclusions show a negative view on SkinTE. We show the physician™s remarks below, followed by our explanation. We asked Dr. Swanson about the physician™s remarks and include his responses below as well.

The Expert Physician™s Remarks on SkinTE:

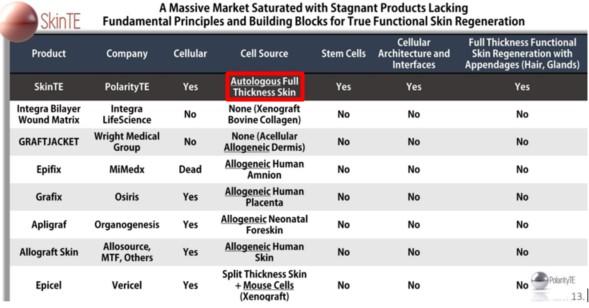

The FDA does not regulate basic skin grafts

Polarity claims that its SkinTE technology works, but they should not be able to make any strong marketing claims given the fast regulatory path that they have chosen. It appears that they are going too far with their marketing statements (refer to slide 13 where they reference œautologous full thickness skin) “ the company can™t make this statement as it is not validated by data. To the extent that it could market this, it would have to go down the path of having the FDA approve it. This is a total 5-10 year process of going through clinical trials and presenting the data to the FDA to attain the FDA™s stamp of approval. The company also has inappropriate marketing on slide 15 where they imply they spur hair growth, but there is no study to substantiate this either.

The basic science here is very rudimentary. It is a pretty common medical procedure to take skin from one part of the body (say one arm) and put it on another part of the body (say the other arm). Polarity is allowed to sell this but I don™t see any value as why would anyone pay a premium for this. What you can™t do is say that you do this better than the competition (which is what Polarity is saying), especially if you have no underlying testing or data that substantiates this“ and this will be a big problem for them.

Not sure how the company is going to be able to pitch physicians, on what basis will they convince physicians that this product is better than any other. Put another way, if they don™t have testing, they don™t share data, they have no FDA approval, they are not going after any meaningful approval, and they don™t have a patent “ how can a physician, based off their fiduciary duty, recommend this.

In regards to the above expert physician analysis, first, he mentions the regulatory path that Polarity has chosen. They chose to go down a path where premarket approval isn™t necessary. With that method, the FDA doesn™t need to look at the product. PolarityTE can go ahead and sell it right away to physicians. Going down this path limits what PolarityTE can say about its product, as nothing has been proven through trials. It is also debatable whether the SkinTE is applicable under the category of no approval necessary, as there needs to be œminimal manipulation of the skin. An outline of the differences and requirements between the two regulatory pathways for HCT/Ps (Human Cellular and Tissue Products), 351 vs. 361, can be found in this presentation by Arent Fox.

The expert refers to slide 13 from the Polarity investor slide deck shown below:

The expert physician said PolarityTE can™t make claims like œAutologous Full Thickness Skin, unless it™s proven in trials. PolarityTE wants doctors and investors to just take their word for it “ for now. Later, PolarityTE is going to do trials with its customers. That way, it can decide which types of trials would be best to show what the product can do. It doesn™t have to follow any orders by the FDA. That appears to be a bullish data point for the stock.

We brought up the expert physician™s concerns to PolarityTE™s management. Here™s what Dr. Swanson told us on the subject:

We are quite diligent at running our statements based on a variety of legal counsel. We have King and Spalding, they are our FDA counsel team, counsel compliance team, and promotion team. We have them look at everything before it goes out. On that front, we feel comfortable. And there are always things we need to be aware of. With what you read or what that person has found out, I™m sure most of those things must have been prefaced with they have been done in our preclinical models. It™s definitely autologous. We can definitely say it™s autologous whether we™re dealing with mice, pigs, rats, humans, or anything in between. Autologous just means from that person, for that person. In terms of us saying it regenerates full thickness skin, those statements were all made about our preclinical models. If he just read one sentence out of context, he may have gotten confused on that but they were all made in the appropriate context.

This regulatory pathway PolarityTE is going on allows the company more freedom with the trials and what market its product is ideal to sell to. Bigger companies with skin replacement therapy products like MiMedx (MDXG) and Allergan (AGN) have products under the same FDA regulation. The main requirement to watch out for here is œminimal manipulation. According to Mr. Stetson, PolarityTE uses minimal manipulation because it™s taking cells in the same formation from one part of the body and placing it on another part. The cell structure stays in line.

PolarityTE Plans To Launch SkinTE Commercially In H2 2017 Despite Having Never Tested It On A Human

To date, SkinTE has not been tested on humans in a clinical trial setting. It has only been tested in the preclinical stage on mice and pigs. There is also no published safety or efficacy data from preclinical studies showing the value of this technology. There is so far nothing in medical journals.

In June, 2017, PolarityTE announced the successful regeneration of full-thickness skin and hair on pigs. Also announced in the PR is the company™s plans for a human clinical trial in Q317. The PR says:

The Company expects to initiate a human clinical trial evaluating the autologous homologous SkinTE construct in the third quarter of 2017.

Now Q317 is over, and there hasn™t been any human clinical trials started.

The following is from slide 16 on Polarity™s IR deck:

As shown above, the company did the first three stages of preclinical development for SkinTE by the book. First, the product is tested ex vivo, then graduate to small animals, then large animals. But then, the next stage, clinical deployment, has not been started yet.

Not going the traditional biotech route of clinical trials is PolarityTE™s strategy. With the 361 regulatory pathway that PolarityTE went on, there is no FDA approval stamp. There are a lot of skin products and fake tissue products that are in this industry that have also gone the 361 route and have never received FDA approval. What PolarityTE plans on doing is designing the clinical studies with physicians, and some of the physicians can do their own independent studies to provide their own evidence that they™re looking for. PolarityTE and its physician customers can design their own studies that provide the highest level of evidence. The physicians using SkinTE consistently and in high volume, with high numbers of patients, can compare it with other products and techniques they have used.

What If It Works On Pigs But Not On Humans?

Even though the preclinical results aren™t posted in detail, the company claims that SkinTE was a big success with tests on swine. Dr. Swanson said that the results will be published in medical journals soon. According to him, the results have been submitted to the medical publications. It just usually takes a couple of months to finally get published after being submitted. If investors are considering buying, or shorting, this stock, they might want to wait for upcoming articles on the technology in medical journals to start evaluating the data.

Dr. Swanson explained that there have been models of swine skin that are 80% and up to 90% predictive of human wound healing. As explained in this article, "Pigs are well suited for skin studies. Although rat, mouse, and rabbits have been used for skin studies, pig skin has been shown to be the most similar to human skin". PolarityTE™s tests are regenerating skin, which is more difficult than simply healing a wound. In the swine model, PolarityTE regenerated wounds in a 10x10cm area down to the muscle where there was no skin in that wound. Dr. Swanson claims that SkinTE generated full thickness skin with hair in the middle of the wound.

œSince SkinTE was effective in swine, it should and will work in humans. That™s not a reach, Dr. Swanson said.

œWe™ve had physicians, even bankers who used to be dermatologists, say ˜you did it in swine, so we™re excited in the humans because of how close it is,™ said Dr. Swanson.

PolarityTE™s Latest Financings Are Preferred Stock With Price Protection “ Similar To Death-Spiral Financing

PolarityTE™s recent preferred stock financings are œratcheted which gives the investors price protection if the stock goes down. The two September financings here and here have the same terms. We believe it is somewhat misleading the way the company reported them as an œabove market private placement in the PR, and not mention the price protection feature. On September 21, 2017, PolarityTE announced:

PolarityTE Announces Closing of $17.75 Million Above Market Private Placement

In the PR, it states:

PolarityTE, Inc. today announced the closing of $17.75 million of Series F Convertible Preferred Stock. The preferred stock shall be convertible into the Company's common stock at a conversion price of $27.50 per share and the investor shall receive one half warrant exercisable at $30.00 per share.

On September 21, COOL was trading at about $26.50. Therefore, the PR says œAbove Market since the conversion price on the preferred stock and exercise price on the warrants was above the market price at $27.50 and $30, respectively. This makes it seem like the preferreds were an underpinning of value at $27. However, the opposite is actually the case. These preferreds are full ratchet. That means that if the company sells stock for a lower price in the future, the conversion price of the preferreds changes to that price and the warrant exercise price changes to 110% of that price.

So, the investors in these preferreds are meanwhile receiving 6% interest, and if the company raises money at a lower price, they get their preferreds locked in at that price, and they can convert at the lowest price and then sell in the open market whenever they want.

From the 8-K on the private placement:

For the preferred stock conversion price:

For so long as a holder has Series F Preferred Stock, if the Company sells, or is deemed to have sold, Common Stock, or common equivalent shares, for consideration per share less than the conversion price in effect immediately prior to the issuance (the œLower Issuance Price), then the conversion price in effect immediately prior to such issuance will be adjusted to the Lower Issuance Price.

And, for the warrant exercise price:

For so long as any Warrants are outstanding, if the Company sells, or is deemed to have sold, Common Stock, or common equivalent shares, for consideration per share less than the exercise price in effect immediately prior to the issuance, then the exercise price for outstanding Warrants will be reduced to one hundred and ten (110%) percent of such other lower price.

There are additional terms on this financing that make it even less risk for the investors. It says:

...the shares of Series F Preferred Stock are convertible into shares of Common Stock based on a conversion calculation equal to the stated value of the Series F Preferred Stock, plus all accrued and unpaid dividends, if any, on such Series F Preferred Stock, as of such date of determination, divided by the conversion price.

And, the above statement doesn™t include the warrants in the deal, as the investor gets warrants for free equal to 50% the amount of converted common stock the investor will get from the preferred shares.

With this price protection terms, the buyer of these preferred and warrants has almost no risk, compared to the risk investors take who buy the stock the on the open market.

PolarityTE™s CFO, John Stetson, has a different view. He said regarding the price protection with the preferreds and warrants:

This financing was structured that we want the investors to be long term shareholders. The structure is above market. Weigh this deal against raising money, if we raise money, it could have a 15%-20% discount. Bankers said this was great terms.

I™ve never had so many phone calls from bankers that are impressed by this deal. Many deals with biotechs have price protection at lower than the market.

It™s A Reverse Merger: A Videogame Developer Transitions To Regenerative Medicine

PolarityTE came into existence in December 2016 when it reverse merged into publicly traded Majesco Entertainment ((NASDAQ:COOL)). Majesco was a struggling video game developer. With it clearly failing, major shareholders Barry Honig, Michael Brauser, and Philip Frost pulled a classic pivot and merged their public vehicle with PolarityTE.

In return for providing the PolarityTE asset to Majesco, Dr. Denver Lough received preferred shares convertible into 7.1 million common shares at $1.00 per share, representing a 50% pro forma stake in COOL. As stated in this SEC filing:

PolarityTE NV™s common stock held by the Seller will be converted into the right to receive 7,050 shares of the Company™s Series E Preferred Stock convertible into an aggregate of 7,050,000 shares of the Company™s Common Stock.

And

The stated value of each Series E Preferred Stock is $1,000 and the initial conversion price is $1.00 per share.

The œSeller in the filing refers to Dr. Lough.

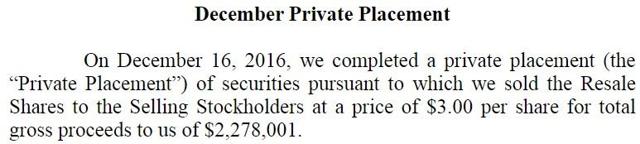

The company did a concurrent private placement in December 2016, selling 759k shares at $3.00 per share for gross proceeds of $2.3 million, as shown here.

Investors of that private placement in PolarityTE who are still holding have earned an 800% return in less than a year.

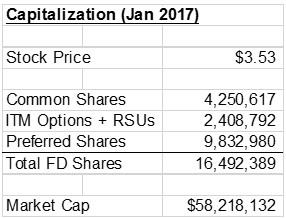

Despite having a basic market capitalization of only $15 million at the time, Majesco had options, warrants, and preferred shares convertible into more than 12 million additional shares, giving the company a fully-diluted market cap of $58 million, as shown in the figure below:

Figure 1: COOL Capitalization as of January 2017

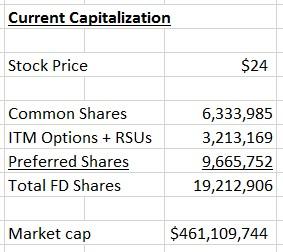

Let™s fast-forward to today. PolarityTE™s share price has rocketed to $24.00, giving those early private placement investors a juicy 8x return in less than a year. The fully diluted market cap has ballooned to about $460 million, as shown below:

Figure 2: Capitalization Today

One can look at the company's outstanding options, warrants, and preferred shares in this SEC filing.

There are different lockup lengths for each of the options, warrants, and preferred shares. Dr. Lough™s preferred shares have the furthest lockup expiry date of April 2019. In the short term, that™s good for shareholders, but long term, eventually, he will be able to convert those shares and increase the float share count.

PolarityTE™s Total Addressable Market

In its June 2017 conference call, PolarityTE quantifies the size of the skin regeneration market for burn victims to be $5 billion. Dr. Lough said:

If you start looking at just skin regeneration for burn itself, it can be, - and for wounds - will be roughly around $5 billion.

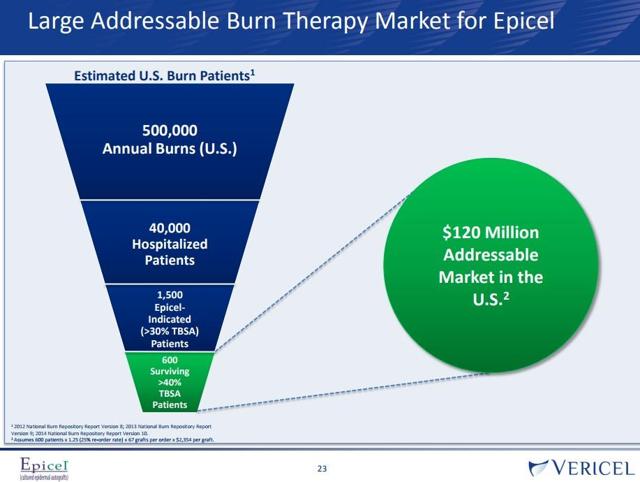

The expert physician we interviewed said that Vericel (VCEL) is a close competitor to PolarityTE. Dr. Lough also mentions Vericel™s product, Epicel in the conference call as a competing product. He said:

With regards to the competitors themselves, I will kind of turn it back on you, the shareholders and the analysts, name one other product that™s out there that is truly autologous, homologous, and there really isn't one. There are groups that are out there like Epicel - cultured epithelial autografts. They™re a good company, they™re a good product.

Let™s compare Epicel to PolarityTE™s SkinTE. First, Epicel is an FDA approved product, SkinTE is not. Vericel was formerly part of Genzyme/Sanofi (NYSE:SNY) before being purchased by a public vehicle in 2014. Epicel has gone through the FDA regulatory process and was granted approval under the Human Device Exemption (HDE) in 2007.

Vericel has estimated its total addressable market (TAM) is $120 million as shown below from Vericel™s August 2017 investor presentation.

That $120 million market is only for burn patients that have over 40% of their body covered in burns. That™s not a big market. Speaking with Mr. Stetson, he said that the reason why Epicel has such a small market is because it™s limited by what it was approved for by the FDA. Given they can only treat a certain part of the market, they are limited to who they can treat. They are under a certain code. That™s a big downside sometimes of going through FDA approval.

Said Mr. Stetson:

Vericel went through a regulation guideline that restricted the population they can treat, they probably didn™t know it at the time. Under our registration, we don™t have those restrictions.

Epicel takes care of the keratinocytes, the uppermost layer of the skin. Epicel uses outside growth factors, they use mice t3 cells, they culture it, they add a lot of film to it, it takes them four weeks to get the product back to their patient because they are doing all these things under the FDA™s scrutiny.

The FDA isn™t worried about what Polarity is doing because they™re homologous and autologous, their manufacturer is GTP (Good Tissue Practices) compliant, and they™re not manipulating the cells under the FDA™s guidelines. This allows Polarity the freedom to put it in pretty much all wounds and burns.

With the burn market and wound market PolarityTE is going after, management doesn™t know the size of its market because it can go into many indications. SkinTE replaces the skin graft. SkinTE is fully homologous and analogous.

SkinTE™s Potential Market Size

PolarityTE™s literature shows that there are 150K burn patients per year that require surgery per year. The average burn size is 14% of the total body surface area, which equates to 2,400 square centimeters.

If you look at MiMedx Group, it gets reimbursed at $250 per square centimeter.

Integra Life Sciences (IART) has scaffolds which are used for physicians to put their skin grafts on top. Integra gets reimbursed over $130 per square centimeter.

What PolarityTE plans on doing is taking the lowest reimbursement of any type of surgical burn product, which is in the $30 range. $30 x 2,400cm for the average burn size is a cost of $72K. That™s per patient, and there were 150k patients in 2014. This estimation makes the market size for SkinTE $10.8B.

And then, SkinTE can get into chronic and acute wounds. And with flaps, plastic stuff done, a tummy tuck, you need to take skin from another part of the body, which is another market SkinTE will be a part of. And that™s just skin. Plus there™s bone, cartilage, and muscle which are also large markets that PolarityTE is also hoping to develop products for.

Said Mr. Stetson:

The standard of care now for burn victims is a skin graft. We™re going after burn because we™re competing against a skin graft. There isn™t much risk with our product. The risk is it doesn™t work, but you™re not harming the patient if it doesn™t work. I™m using the patient™s own tissue, how can I hurt them with their skin? We™re going after burns, because even if it™s as good as a skin graft, it works. A skin graft is difficult for the physician and painful for the patient. The reason why physicians are excited about this is because even if it™s just as good as a skin graft, they don™t have to go through the painful surgery, the time it takes, these patients are in the hospital for a very long time, and they don™t have to be left with another scar from the skin grafting. This product is an entirely different type of technology than what™s being used now. Other companies don™t have our products. That™s why we™re going after burns, the competition is non-existent. Burn centers are our first market we™re going to. Depending on how you define the burn or wound market, we™re estimating between $5-$50 billion just for burn and wound.

A burn is a much worse wound. If SkinTE works with burn wounds, then it should work on other types of skin wounds too. Also, if it can cure and regenerate skin from a full thickness burn to the muscle, then it would work on a non-full thickness wound too.

SkinTE™s Total Addressable Market Is Likely Overstated By The Company

We disagree with the company and Mr. Stetson about the estimated TAM. In the estimation above, he™s taking the entire patient burn market. It™s possible that SkinTE will have a sizable niche in the burn market, but no one product usually takes up the entire market in a space. In most industries, certain products work better for specific situations. As stated above, when Epicel got FDA approved, its TAM got decreased. We believe it™s likely that after SkinTE starts being used, and clinical studies recorded, physicians might find it works better for a particular burn or skin wound. That would decrease the company™s estimated TAM considerably.

Skin replacement therapy company MiMedx has annual revenues currently about $300 million. Vericel's is about $60 million. If PolarityTE's SkinTE product is effective, it will likely be somewhere in that range.

A Look At A Promotional Forbes Article On PolarityTE

After reading this August 2017 Forbes article titled, PolarityTE: Will This Biotech Be The Next Amazon Or Tesla?, one might be tempted to believe that PolarityTE has something special. However, we believe there are some quotes in this article that suggest PolarityTE is an over-hyped promotion.

This article™s author, Jeff Dyer, has a major conflict of interest with his opinion and PolarityTE. Dyer was appointed to PolarityTE™s board in March 2017 as an independent director. Dyer was granted options to purchase 141k shares of COOL at $3.12 per share. At the current share price, Mr. Dyer™s options are worth a whopping $2.8 million.

In the article, PolarityTE™s COO Ned Swanson is quoted:

After pursuing multiple deal structures with private investors, debating our valuation became tiring, which in the private markets in a pre-revenue pre-clinical biotech company is almost entirely imaginary. Taking our company public out of the gates gives us the opportunity to tangibly prove to the world what we™re worth because the capital markets will give us that answer daily.

The implication here is that private venture capital firms looked at this company did their due diligence and came up with a valuation that is far below the whopping $400 million+ market cap of the company today.

The article states (emphasis ours):

Lough and Swanson are taking a huge gamble because the culture in the medical community is that you don™t leave to try a start-up and then come back if it doesn™t work.

Indeed, based on interviews with over a dozen current or former Hopkins clinicians, none can recall the director of an important Center at Hopkins leaving for a start-up. This is only possible because PolarityTE can offer attractive equity options. [emphasis added]

We can now see how COOL (i.e., Honig, Brauser, and Frost) attracted Dr. Lough to their platform. With his 7.1 million preferred shares convertible into common at $1 per share, and 1 million options at a $3.15 exercise price, Dr. Lough now has an equity stake valued at over $150 million.

PolarityTE™s SkinTE Product Is œPatent Pending

In the company™s IR deck, on page 6 it claims that Dr. Denver Lough is the inventor/innovator behind patented PolarityTE platform. However, in the company™s latest 10-Q, it clearly indicates that the company's asset is a patent application that has not yet been granted by the USPTO.

The patent application sold to PolarityTE by Dr. Lough is titled: œMethods for Development and Use of Minimally Polarized Function Cell Micro-Aggregate Units in Tissue Applications Using LGR4, LGR5 and LGR6 and holds a publication date of June 9, 2016.

From reading the application description, it is mainly based on the recently characterized (2010) stem cell marker, LGR6. Since 2010, significant research has been done on LGR6+ cells, which questions the strength of PolarityTE™s IP. The LGR6 marker was not discovered by anyone at PolarityTE, so its technology may not be proprietary. While the company may be able to obtain patents for manufacturing processes or specific product features, these may be easily circumvented by other companies wanting to utilize the LGR6+ biology.

According to Dr. Swanson:

In terms of cells that have LGR expression, LGR 4,5,6. We can™t patent a cell that expresses LGR, that™s a naturally occurring cell. People can use the cell depending on their patents. That™s one portion, one snippet of the core composition of our technology. It™s not a patent on the cell itself if that makes sense.

We™re pursuing the broadest and most protective IP strategy we can. And that includes composition, methods of use, methods of harvest, etc. And the application thereof, so it would be everything you just said, to totally put an umbrella over what we have, including trade secrets.

We can™t comment on other company™s freedom to operate if they™re trying to do a similar technology to us or not, as far as we™re aware. Most people don™t understand what we™re doing. So the trade secret is important to what we™re patenting. We™ve had very intelligent, powerful companies and people, and no one has been able to produce even close to what we™re doing.

There have been heavily interested parties in what we do and how do it because of how well it has worked so far, and what we™ve done with the clinical models, and what is expected to happen with the human data. This is a constant given on that front. Because so many people and so many investors, banks, biopharma companies are looking at this heavily.

Conclusion

Although it is possible that PolarityTE has the revolutionary skin regeneration technology that management says it has, there are many red flags that investors should pay attention to. The stock has appreciated a whopping 800% this year, despite minimal progress from the company since its reverse merger at the beginning of the year. Its valuation has ballooned to over $400 million at $24 per share. The fact that the company struggled to make a deal with VC firms suggests that the stock might be overvalued right now.

PolarityTE™s œrevolutionary skin regenerative technology is only a patent application. PolarityTE is racing to get its product on the market by utilizing an FDA regulation which it can then conduct studies with its customers at the same time it sells them the SkinTE product. The company is getting ready to ramp up its sales and R&D now, so it™s a very pivotal time.

The stock could continue going up if more investors start to believe the company™s story. This could come from more publications in medical journals, as well as positive feedback from customers. But the opposite could happen too. If the company isn™t able to sell its product, or published studies in medical journals aren™t convincing, and physician experts are critical or skeptical, then the stock can come back down.

Going long or short COOL right now is a gamble because we don™t know enough yet about how effective the technology is. We believe shorting has a higher probability of success, because it™s more likely the stock will retrace a bit from its huge 800% runup since the beginning of the year. The safe play is to stay on the sidelines and wait for more information to emerge about PolarityTE™s product before taking a position long or short. With initial sales and studies underway, this company with the mysterious technology will soon reveal itself.

Disclosure: I am/we are short COOL.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Oh wow, they were on Fox news. ^^^^^^^^

_____________________________________________________________________

Also, from Sunogel's Facebook:

Hello everyone,

Unfortunately I did not receive a call today either from PolarityTE. I will send them another e-mail and attempt to schedule and hopefully they respond. I'm not sure if they were too busy or what happened. I'll keep the questions saved incase they contact me again or reply.

Good afternoon everyone.

I have e-mailed PolarityTE again and to my surprise they responded very quickly. I was sent an apology for the missed phone conversation and was asked if this Thursday I would be available.

I'm not sure if they were just pretty busy or what happened, but it looks like we're still set for a phone conversation with them.

2 hours ago, mjg713 said:Does anyone know if the skin healed by Polarity is elastic, has melanocytes, sweat glands, etc. There is a lot more characteristics to skin than just hair follciles.

Yes it regenerates full thickness skin with all of its appendages.

Sweat glands, sebaceous glands, blood vessels, hair follicles etc...

You can find all that in their investor presentation on their site as well as their YouTube video on their channel: "PolarityTE" where the CEO states it all from his own words as well.

12 minutes ago, Tano1 said:Yes it regenerates full thickness skin with all of its appendages.Sweat glands, sebaceous glands, blood vessels, hair follicles etc...

You can find all that in their investor presentation on their site as well as their YouTube video on their channel: "PolarityTE" where the CEO states it all from his own words as well.

Thank you, I read that but was unsure what exactly they meant by appendages. Wow, I have to say this really does look like the holy grail.

On 31.10.2017 at 7:48 PM, Tano1 said:Good afternoon everyone.I have e-mailed PolarityTE again and to my surprise they responded very quickly. I was sent an apology for the missed phone conversation and was asked if this Thursday I would be available.

I'm not sure if they were just pretty busy or what happened, but it looks like we're still set for a phone conversation with them.

Have you any question about the clinical trials? Are they going to make it available worldwide through theclinicaltrials.gov website for example? Or are they going to collaborate with some EU clinical or Chinese, etc? It will help them to accelerate such innovation.

1 hour ago, GeneTrouble said:Have you any question about the clinical trials? Are they going to make it available worldwide through theclinicaltrials.gov website for example? Or are they going to collaborate with some EU clinical or Chinese, etc? It will help them to accelerate such innovation.

I can answer that actually.

No the clinical trials will not be made available worldwide because they are only a recently merged company that aren't big enough to extend clinical trials into other countries. Nor do they have facilities in other countries for them to produce SkinTE. They have however, just purchased a facility in Utah where they plan to begin accelerating manufacturing efforts to make SkinTE available in themarketnationwide.

The other reason they can't make trials available worldwide is because of the nature of burn wounds they're treating (3rd degree burns.) They are time sensitive cases. Not because of anything to do with the treatment itself (there's no time limit for when SkinTE can be applied), but because the burns themselves can worsen a patient's condition and/or result in death if severe enough; therefore, any burn victims would need immediate medical attention and they can't get that from PolarityTE because they don't have facilities. The clinical trials won't last very long either. I believe they plan to publish that data within 1H 2018. I am not sure if they're testing other burn types or existing wounds. We will get an answer to that soon.

Collaboration with other countries would probably be out of the question until their patent expires after they've fully launched and acquired enough revenue to extend their services. Perhaps in the future they will set up facilities in other countries (assuming it complies with said country's medical criteria) once they've branched out fully into cosmetic/scar revision and hair regeneration as well since they're presented with additional markets that would make extending it to other countries worthwhile. I can see this being available in Japan and Europe based on some of the regulations I've seen regarding other research and developments, but that statement is only just my opinion and nothing more.

13 hours ago, Tano1 said:I can answer that actually.No the clinical trials will not be made available worldwide because they are only a recently merged company that aren't big enough to extend clinical trials into other countries. Nor do they have facilities in other countries for them to produce SkinTE. They have however, just purchased a facility in Utah where they plan to begin accelerating manufacturing efforts to make SkinTE available in themarketnationwide.

The other reason they can't make trials available worldwide is because of the nature of burn wounds they're treating (3rd degree burns.) They are time sensitive cases. Not because of anything to do with the treatment itself (there's no time limit for when SkinTE can be applied), but because the burns themselves can worsen a patient's condition and/or result in death if severe enough; therefore, any burn victims would need immediate medical attention and they can't get that from PolarityTE because they don't have facilities. The clinical trials won't last very long either. I believe they plan to publish that data within 1H 2018. I am not sure if they're testing other burn types or existing wounds. We will get an answer to that soon.

Collaboration with other countries would probably be out of the question until their patent expires after they've fully launched and acquired enough revenue to extend their services. Perhaps in the future they will set up facilities in other countries (assuming it complies with said country's medical criteria) once they've branched out fully into cosmetic/scar revision and hair regeneration as well since they're presented with additional markets that would make extending it to other countries worthwhile. I can see this being available in Japan and Europe based on some of the regulations I've seen regarding other research and developments, but that statement is only just my opinion and nothing more.

Yeah, the foreign regulatory agencies are kind of weird. They seem to be all over the place.

Good evening everyone. Hope you're all staying warm!

I just got off the phone with Dr. Swanson COO and Vice President of PolarityTE and have received some detailed answers. I apologize that the first 2 questions I wasn't able to record because I didn't realize that I couldn't minimize my voice recorder application or else it would pause the recording (thankfully I re-opened it after the second question to check it.) I did however remember his detailed responses on those 2 questions so I will be able to give you accurate information on both. I will also post the questions I asked with exact wording of how I asked them along with Dr. Swanson's responses (omitting the UHs, UMs and throat clearing because I'm a little sick.)

Almost all questions were answered, but unfortunately I couldn't ask them all. We had been speaking for almost half an hour and in the beginning he had told me he did have some free time to discuss some of the questions I had so I kept trying to push to get as many as I could to get answered.

Some questions were merged and/or re-phrased so I believe I was able to word them in such a way that should be able to give you a general answer to your question. Just a couple of questions that couldn't be asked but I think they were at least partially still answered by the other questions I asked.

Give me a couple of hours to get everything posted. I will type out everything here and I may make the audio portion available another day.

Edit: I wasn't able to finish typing the whole interview out since it's getting late for me and it's taking longer than I had expected so I saved what I had and will finish and post it tomorrow as soon as I get the chance. It will be a fairly large post with the 10 questions that I was able to fit in.

Acne.org Products

Acne.org Products